Most loan providers don't offer a succeeding mortgage backed by the very same residential or commercial property. A 5/1 adjustable-rate mortgage is an ARM that preserves a set interest rate for the very first 5 years, after that adjusts each year after that. As their name suggests, reverse home mortgages are an extremely different financial item. They are developed for home owners 62 Click here or older that intend to transform part of the equity in their homes right into money. ARMs typically have limitations, or caps, on just how much the rate of interest can increase each time it changes and also in overall over the life of the finance. Remain in the recognize with our latest house tales, home loan prices as well as re-finance suggestions.

- It can likewise help you identify how costly a residential property you can fairly pay for.

- All of it boils down to understanding the options available so you can select what's right for your scenario.

- Enable customers to get a good friend or relative to either finance them a deposit or put up their property or savings as safety.

- Adhering finances-- As the name implies, an adhering loan "adapts" to a collection of standards put in place by the Federal Real Estate Money Company.

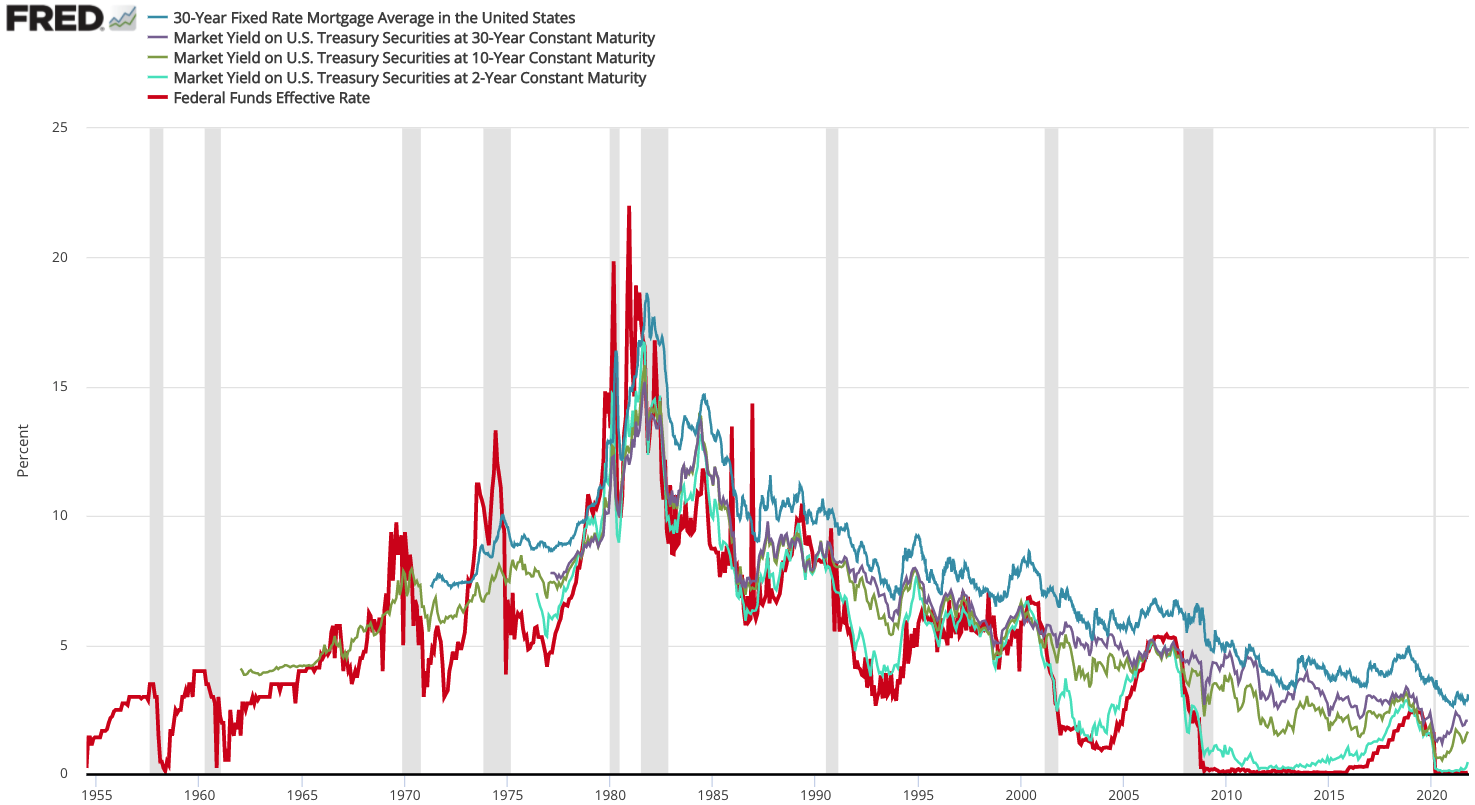

The 30-year fixed-rate home mortgage is a home loan with a rates of interest that's set for the whole 30-year term. If rate of interest in the home loan market go down, you might wind up paying more than you would certainly on a variable-rate offer. A great alternative for those on a tight budget plan who desire the security of a repaired monthly payment. Fixed-rate home mortgages were the most popular in our 2019 home mortgages survey, with six in 10 stating they had one.

What Is Out Of Work Car Loans?

The most significant advantage of having a fixed rate is that the property owner recognizes specifically when the passion and also primary repayments will certainly be for the size of the financing. This enables the homeowner to budget easier since they understand that the interest rate will certainly never ever transform for the duration of the funding. A mortgage by conditional sale is https://allach7dd1.doodlekit.com/blog/entry/21196694/just-how-do-basis-point-walkings-impact-a-home-loan when the debtor sells the residential property to the mortgagee on the condition that the sale will certainly become absolute if there is a default of settlement. Likewise, on the payment of the money, the sale will come to be space and also the mortgagee will move the residential or Timeshare Refinance Banks commercial property back to the mortgagor. Than on a lot of other lendings, offering relatively reduced monthly payments at first. 2- as well as five-year offer periods are one of the most usual, and when you get to the end of your fixed term you'll typically be carried on to your lender's typical variable price.

What Are The Various Kinds Of Home Mortgage?

Typically, you 'd pay interest-only repayments for a few years then start making primary settlements in the future. If they are presently offered, a 95% lending to value mortgage permits new purchasers to contribute a 5% down payment. If qualified, this suggests you can possibly obtain as much as 95% of your residential or commercial property's worth or the purchase rate.

There is the risk of a succeeding legal home loan for an additional event. If the fair mortgagee parts with security, the borrower might develop a 2nd legal home mortgage over the very same residential property, also for a brief period. The customer might hold the title deeds out his account however in the capacity of a trustee. If an equitable cost is created, the insurance claim of the recipient under the count on will certainly dominate the equitable mortgage.